The 6-Minute Rule for Property Damage

3 Simple Techniques For Property Damage

Table of ContentsLoss Adjuster Can Be Fun For AnyoneProperty Damage Things To Know Before You Get ThisNot known Details About Public Adjuster The Single Strategy To Use For Property DamageThe Facts About Public Adjuster RevealedGetting The Property Damage To Work

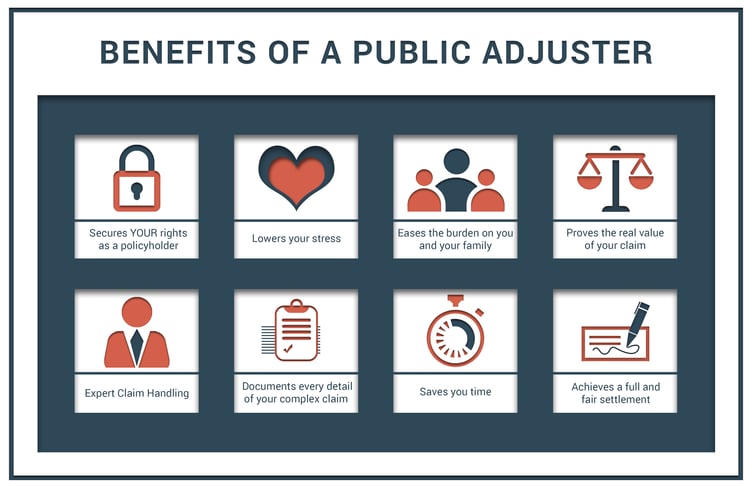

If you wish to see to it that you get all the advantages offered by your insurance coverage and also the biggest negotiation possible, it deserves calling a public insurance coverage insurer today! They are experts that function to obtain you the ideal negotiation feasible from your insurance provider. They can assist determine what is as well as isn't covered by your plan, as well as they will handle any type of conflicts or settlements on your behalf.There are one-of-a-kind types of insurance claim adjusters: The insurance policy holders themselves and not the insurance provider hire public adjusters. Outdoors insurer acquired by the insurer. Usually from large firms that concur to the insurance provider's pre-set methods. Personnel insurers are worked with by the insurer. They are either outside professionals or a lot more commonly function within the business itself (loss adjuster).

Out of all the courses of insurance case adjusters, public insurance adjusters are the only ones that are independent of insurance coverage companies. They are employed by the policyholder to discuss the claim as well as to ensure that they get the proper amount of money. The objective is to obtain the insurance provider to cover the whole damages or loss to their buildings or property from a calamity or crash.

The Only Guide to Public Adjuster

They were put right into place to ensure that insurance coverage business would pay all claims from customers as well as not try to reduce prices by underpaying for an insurance claim or denying it altogether. The general public insurance adjuster's job is simple: they examine your policy, establish what you are owed, as well as after that fight in your place to obtain the complete settlement.

If you have a home mortgage, the lien holder likewise will be a payee, as will certainly any various other events with insurable rate of interests. A public adjuster works as your agent to the insurance provider. Their purpose is to navigate all phases of the insurance claim process and also advocate for the finest interests of the guaranteed.

Rumored Buzz on Loss Adjuster

This permits the guaranteed to focus on other, more crucial jobs instead of handling the anxiety of insurance policy negotiations. This is particularly practical in the days and also weeks following a loss. There are various duties that public insurance adjusters execute for the insurance policy holder: Determine Coverage: Examine and take a look at the insurance policy as well as establish what protection as well as limitations apply.

Some insurance coverage adjusters have more experience and also will do a better work. Not all insurance asserts comply with a set course.

Property Damage for Beginners

That the negotiation quantity will completely restore the insurance policy holder's residential or commercial property to pre-loss problem. Any type of pointer that proving these things their website is easy, or that a computer can do it for you, simply isn't real. Insurance claims really promptly become a tangled mess because the: Loss conditions are not plainly stated, not correctly examined as well as documented, or they include multiple causes or several policies.

The negotiating process starts as quickly as you incur a loss. In case of a loss, it is very important to be prepared and have all your documentation at hand. If the loss is significant, you might want to reach out to a public insurance insurer. However you ought to inform your insurer asap.

Know that they will certainly be assessing just how much you understand about your policy limits, the damages you have actually suffered and also if you are looking to an agent, public insurance adjuster or insurance service provider for advice. A public adjuster breaks the evaluation cycle, tipping in as your exclusive specialist representative. With a level having fun field, great deals of documents, as well as iron-clad evidence of all appraisals, it is hard for the insurer to say for anything less than a complete and reasonable settlement.

Rumored Buzz on Public Adjuster

The chart below reveals some of the a lot more moderate claims that we have actually aided to settle. As you can see in every circumstances we gained our clients at least dual the quantity of the original insurance policy business offer. public adjuster.

Bear in mind that there is a lot at risk, and the insurance provider has great deals of experience in regulating outcomes. It's very easy for feelings to run hot, specifically when you're the one with every little thing to lose. If generated early, a licensed public insurance adjuster can become the equalizer for you. When disputes arise, your public insurer will certainly recognize what to do a fantastic read as well as work to fix the problem efficiently.

The working out process starts as quickly as you sustain a loss. In case of a loss, it's vital to be prepared and also have all your documents handy. If the loss is substantial, you may wish to connect to a public insurance insurer first. However you ought to notify your insurance coverage business immediately.

Loss Adjuster for Beginners

The graph listed below reveals some of the more moderate insurance claims that we've assisted to clear up. As you can see in every circumstances we gained our clients at least double the amount of the initial insurance coverage firm offer.

Keep in mind that there is a great deal at risk, and the insurance policy business has great deals of experience in controlling end results. It's simple for feelings to run hot, specifically when you're the one with everything to shed. If generated early, a licensed public adjuster can come to be the equalizer for you. When disagreements emerge, your public here are the findings insurer will certainly understand what to do as well as work to solve the issue effectively.